IAPH-WPSP Port Economic Impact Barometer

8 June 2020

Survey set-up

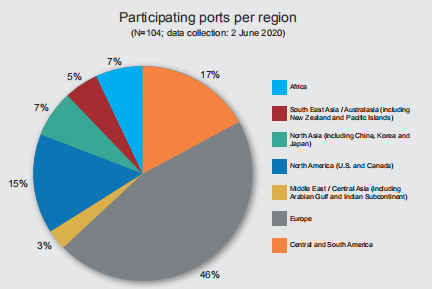

The IAPH-WPSP survey on the impact of COVID-19 is conducted with the aim of monitoring the current situation in world ports and trends compared to previous weeks. The first survey results were collected in week 15 of 2020 (April 6). This week’s results deal with the situation in week 23 (June 2, 2020). A total of 104 valid answers were received, the highest number of respondents to date. Europe continues to be the leading region with 46% of the total (same share as in week 21). The Americas are also well represented with 18 ports from Central and South America (17%) and 16 ports from North America (15%).

African and Asian ports remain underrepresented, although the number of respondents from these regions is on the increase.

Results based on surveys of ports worldwide, eight survey weeks to June 2, 2020

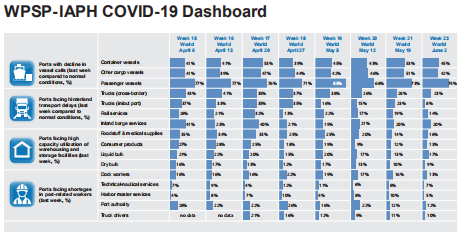

This dashboard provides a visual summary of the results gathered from the IAPH-WPSP COVID-19 Port Economic Impact Barometer survey. The survey initially consisted of six identical questions, sent to port authorities and port operators with responses sent anonymously on a weekly basis. From this week onward, the survey is sent out on a bi weekly basis and the number of questions is reduced to four.

The percentages indicated in the blue bars of the Dashboard highlight the level of impact of COVID19 contagion on world ports based on the responses to the main four questions of the survey, subdivided into relevant categories (vessel, modal, cargo and port worker). You can find comprehensive data and more detailed explanations of responses to those four questions in this report. The last section of this report provides a detailed regional comparison of received answers on the first question of the survey, namely the evolution in the number of vessels calls (container, other cargo and cruise vessels).

1. Impact of crisis on vessel calls

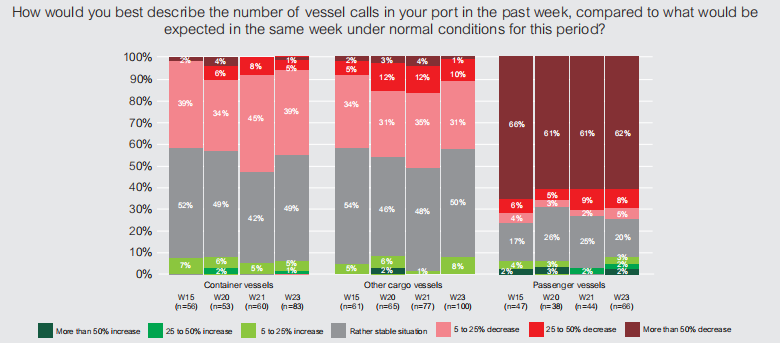

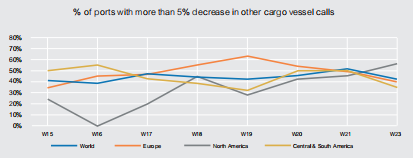

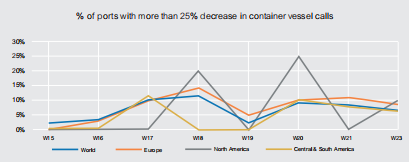

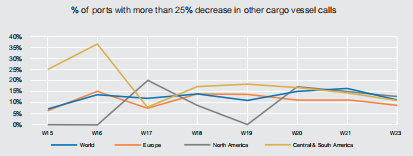

Blank sailings, mainly on trade routes with the Far East, continue to affect this week’s results for container vessels. Their impact is however lower than the one recorded by the Barometer the last five weeks. About 39% of the ports are reporting that the number of container vessel calls fell by 5 to 25% compared to a normal situation. This figure is lower than the 45% of week 21, but comparable to the figures of the first weeks of the survey (weeks 15 and 16). The share of ports facing a significant drop (in excess of 25%) in container vessels calls reaches 6%, a figure that is about 4 percent below the results of weeks 17, 18 and 20, but higher than what we could observe in weeks 15 and 16. The share of ports reporting reductions in other cargo vessel calls of more than 25% dropped from 16% in week 21 to 11% this week, which is below the 12 to 15% observations throughout weeks 16 to 20. Half of the ports are now reporting that the number of calls by other cargo vessels is rather stable compared to a normal situation.

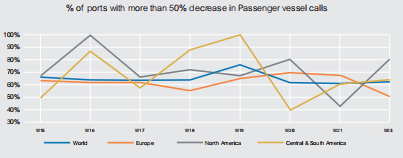

The cruise/passenger market remains the most affected by the COVID-19 contagion. This week’s results are comparable to last week’s. Since week 20, about 61-62% of respondents indicate that passenger vessel calls are down more than 50%, in many cases even down more than 90%. In weeks 15 to 18 this figure amounted to two thirds of respondents with a peak of 76% in week 19. These figures continue to show the effect of an almost complete cessation of cruise activities.

Several ports reported that with the lockdown period of the respective economies over, they head towards increased economic activities comparing to past weeks. Even when the quarantine period has been reduced, more vessels are calling and turnaround has improved. The forecast of a return to normality in some other economies is not foreseen until the middle of June, which explains the persistently lower numbers of calls. A more detailed regional discussion on the number of vessel calls follows in section 5 of the barometer.

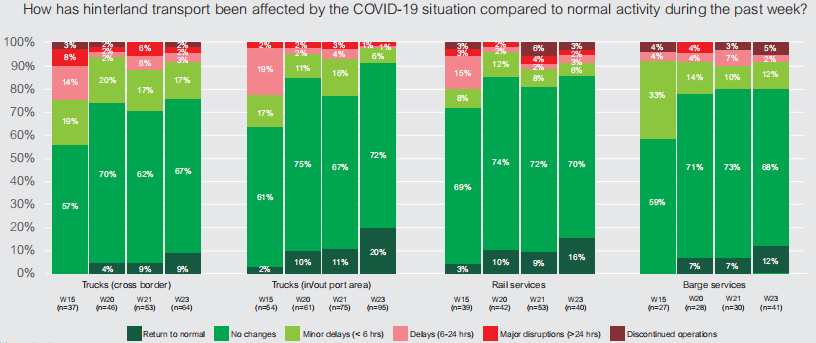

2. Impact of crisis on hinterland transport

Border checks, a lower availability of truck drivers and disruptions in terminal operations can negatively affect trucking operations in/out of the port area and to the hinterland. Only 7% of the ports are still in a precarious position, reporting delays (6-24 hours) or heavy delays (> 24 hours) in cross-border road transportation. This figure is far below the 12% share in week 21 and 18 to 20% in weeks 18 to 19. The situation has gradually improved - 76% of ports either witness a return to normal operations in cross-border transport by truck or are already back to a normal situation. In early April (week 15), only 57% of the ports were experiencing normal cross-border trucking operations. For trucks arriving or leaving the port, we see a significant improvement compared to two weeks ago: 92% of ports report normal activity versus 78% in week 21 and only 63% in week 15. Some 14% of ports still face disruptions in rail services, and very few ports (3%) are reporting a discontinuation of operations. Overall, rail operations are getting back to normal with 86% of ports reporting normal rail operations, the highest figure since the start of the survey.

The situation for barge services is also evolving positively, although the changes compared to week 21 are quite small: 8 out of 10 ports report (return to) normal operations (same as two weeks ago), while most of the remaining ports only face minor delays.

There are no major delay problems with hinterland transportation reported, with the situation remaining or heading to relatively normal levels. No delays were observed in those ports served by rail, yet some cancellations of rail services due to low volumes are present. Road traffic has fallen significantly in April 2020. In some countries such as Brazil, truck voyages almost halved. However, during May a slow recovery took place. In other economies, ports continue to experience a slow movement in hosted activities even though some sectors are reopening. The assumption is that in the new norm the restart of international transactions in countries’ economies is subject to how quickly companies can adjust their way of working.

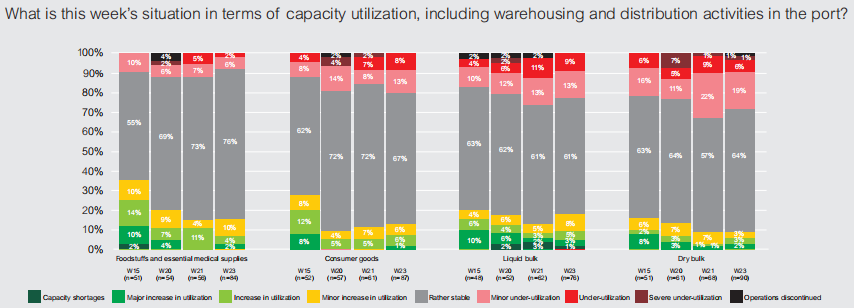

3. Impact on capacity utilization including warehousing and distribution activities

Warehousing and distribution activities in ports may see changes due to the fall in demand for consumer products or the closure of factories in countries with partial or full lockdown measures. Tank storage parks for liquid bulk, and oil products in particular, might see changes in their utilization degree caused by the sharp decline in the oil price and in the use of kerosene, diesel and gasoline.

This week’s survey results show the COVID19 crisis has resulted in only 16% of ports reporting an increase in utilization of warehousing and distribution facilities for foodstuffs and medical supplies and none of the respondent ports report capacity shortages. These figures are slightly up compared to the 14% in week 21, but show a further downward trend compared to the weeks 15 to 20 (note that this figure amounted to 35% in week 15). For consumer goods, 21% of ports are confronted with underutilized facilities and 13% report increases in utilization. It is the third survey week in a row that we have more ports facing underutilization than higher utilization levels. The reverse situation was observed in weeks 15 to 17 with only 10 to 14% of respondents witnessing underutilization and 25 to 28% of ports mentioning an increased usage of facilities or even capacity shortages.

In the liquid bulk market, 61% of the respondents see no changes in utilization levels, a figure that has remained fairly stable since the first week of the survey. About 22% of ports are reporting underutilization of liquid bulk storage facilities (26% in week 21 and a 15-23% range in the first six weeks). Reduced loading and unloading operations are resulting in minor underutilization of existing facilities. The share of ports with increased utilization levels in liquid bulk storage facilities has increased from 13% in week 21 to 17% now.

In the dry bulk sector: 27% of the ports report an underutilization of facilities compared to a 17-25% range in the first six weeks and 32% two weeks ago. The share of ports with increased utilization levels in dry bulk storage has declined to 9%, the lowest figure to date.

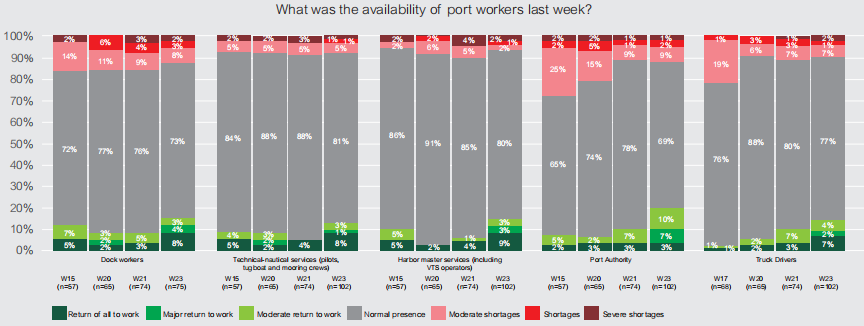

4. Impact on availability of port-related workers

The measures to fight the COVID-19 outbreak up until now have not had a huge impact on the availability of port-related workers. About 13% of the ports mention that they face shortages of dockworkers. This is the lowest share since the start of the survey. Only 7% of the sample face shortages for the delivery of technical-nautical services, while 5% of ports are short of personnel in the harbor master division. As in week 21, about 12% of the port authorities report a moderate to more serious decline in staff availability, compared to 26% in week 18, 22% in weeks 16 and 17 and 28% in week 15. The availability of truck drivers is high: only 10% of the ports face truck driver shortages compared to 11% last week.

Some workforces who are returning to work in cities and port regions are doing so with some flexible measures as part of the re-opening of (some) economic activities. Many port authorities still have part of the staff working at home, i.e. in operations that allow teleworking schemes. Only in a few cases are there reports of port authorities personnel on paid leave. Those groups at risk (e.g. stevedores above the age of 60) remain at home in several countries with financial compensation. Some ports reported that this group represents approximately 30% of the work force. Terminals in some countries also apply rotation or part time working programs covered by social wage schemes. One port reported the setting up of a special working group to discuss back-to-work planning, while another reported that, with the workforce suspended and receiving social wage support, autonomous dockworkers are under severe financial stress.

Working activities in all categories are reported as returning to normal, with procedures to counter COVID-19 established and strictly followed. Protocols for protection of staff and customers are in place with all controls in force. Therefore, the impact on the level of services (productivity, time of attention, and others) is minimal. In fact, with staff getting used to the ‘new normal’ there are ports noting an improvement in the speed of service delivery.

5. Regional comparison: focus on the number of vessel calls

Regional differences are becoming much more pronounced as the world’s ports respond to the Coronavirus crisis. Starting with this report, we include regional comparisons on four key issues moving forward, namely:

• Impact of the crisis on vessel port calls compared to normal conditions at this time of year

• Impact of the crisis on hinterland transport compared to normal activity

• Capacity utilization, including port warehousing and distribution activities

• Availability of port workers, in all categories

This report focuses on the first theme, i.e. the evolution in the number of vessels calls, by comparing global results with regional results. Three regions are considered: Europe, North America and Central and South America. The regional findings for Africa, Asia and Oceania are not reported separately given the low number of responding ports.

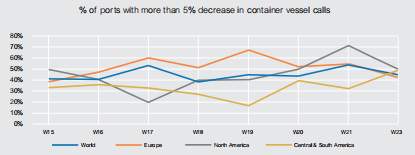

COVID-19 has resulted in a large number of blank sailings mainly on the trade routes with the Far East. These blank sailings have particularly affected the number of mainline vessel calls at hub ports. On a global level, about 45% of the ports currently are facing a drop of more than 5% in the number of container vessel calls compared to a normal situation. This figure has been fluctuating between 40% and 53% since the start of the survey with no clear trend observed. However, the regional results clearly demonstrate that the situation in Europe peaked in week 19 and has shown gradual improvement since then. In the Americas, where the full impact of COVID-19 has been felt later than in Europe, there are no clear signs yet that the situation is improving. On a global scale, a small minority of 6% of ports currently face a decline in container vessel calls of more than 25%. This share reached 10-11% in weeks 17 and 18. The European port system follows the global path, while the results for the Americas in the +25% decrease category are highly volatile.

COVID-19 also affects port calls of other cargo vessels. The global results show that about 42% of the ports currently report a decrease of more than 5% in the number of other cargo vessel calls compared to a normal situation. Since the first week of the survey, this indicator has been moving up and down in a rather narrow bandwidth of 41-51%. Also here, the European results show a peak in week 19 followed by gradual improvement in the past few weeks. The situation in North America is getting worse, while no clear trend could be observed for Central and South America. The share of ports reporting reductions in other cargo vessel calls of more than 25% dropped from 16% in week 21 to 11% this week, which is below the 12 to 15% range for weeks 16 to 20. The European results showing a 25% or higher decline in other cargo vessel calls are clearly below the global survey outcomes since week 20. The Americas show strong fluctuations, although Central and South America seems to move towards a moderate downward slope since week 19.

Central and South American ports reported a decline in vessel arrivals in April, yet this decline has stabilized at the lower levels. While vessel movements have stabilized, less containers are discharged per call. Some service providers have utilized smaller vessels since cargo volumes decreased. Occasionally, the frequency of the container ships and oil tankers has been maintained despite the crisis. In other cases, only few ships entered the port terminal carrying essential cargoes. Terminals that work with offshore supply areas also faced a reduction in vessel calls. Yet, there is an expectation that the industry already experienced its most challenging period and the tendency would be to get back to normal levels. However, there is a lot of uncertainty regarding the “new normal”. It has not been only cargo vessels that have been impacted by local slowdowns. The logistics market has also been affected with some companies reorganizing their supply chain and focusing on essential operations.

In Europe, there have been ports reporting that although container vessel calls have slightly improved, the volumes of goods continue to drop as do the number of liquid bulk calls. For many though, the situation is heading towards a ‘business as usual’ scenario. Overall, a very fragmented situation for containers is becoming evident: some alliances have revamped services, whilst others are keeping cancellations. Some are keeping hi-frequency feeders to major regional ports. A new regional concept for transshipment appears to be emerging.

As mentioned in section 1, the cruise/passenger market has been heavily impacted by the COVID-19 contagion. In the past weeks, about 61-62% of ports around the world are confronted with a decline in passenger vessel calls of more than 50%, in some cases even down more than 90%. This share peaked in week 19 (76%). The situation in European ports was initially a little bit better than the global picture. In weeks 20 and 21, 7 out of 10 European ports reported a more than 50% decrease in passenger vessel calls, followed by a drop to 51% in week 23. The results for the Americas show a high level of volatility. In weeks 15 to 17, the curves for North America and Central and South America still followed a similar path. Since week 18, however, the weekly survey results point to a high level of divergence between the two regions.

As regards passenger services, several European countries, i.e. Finland, Greece, Italy, Spain, have lifted previous restrictions on passenger transport excluding cruises. Cruise traffic remains restricted and non-existent. Cruise services remain suspended in almost every place around the globe. In some cases, this is the outcome of policy decisions by government impacting the entire year, in other cases this is an interim governmental decision (i.e. by one of the Ministries of Health). However, some ports have reopened cruise terminals, shops and restaurants under strict conditions such as liquid antiseptic use, large ventilation fans and social distancing. In other countries, e.g. Canada, cruise ships have been banned and in many cases all passenger services suspended by federal government decisions.

RECOMMENDATION